Energy

Energy

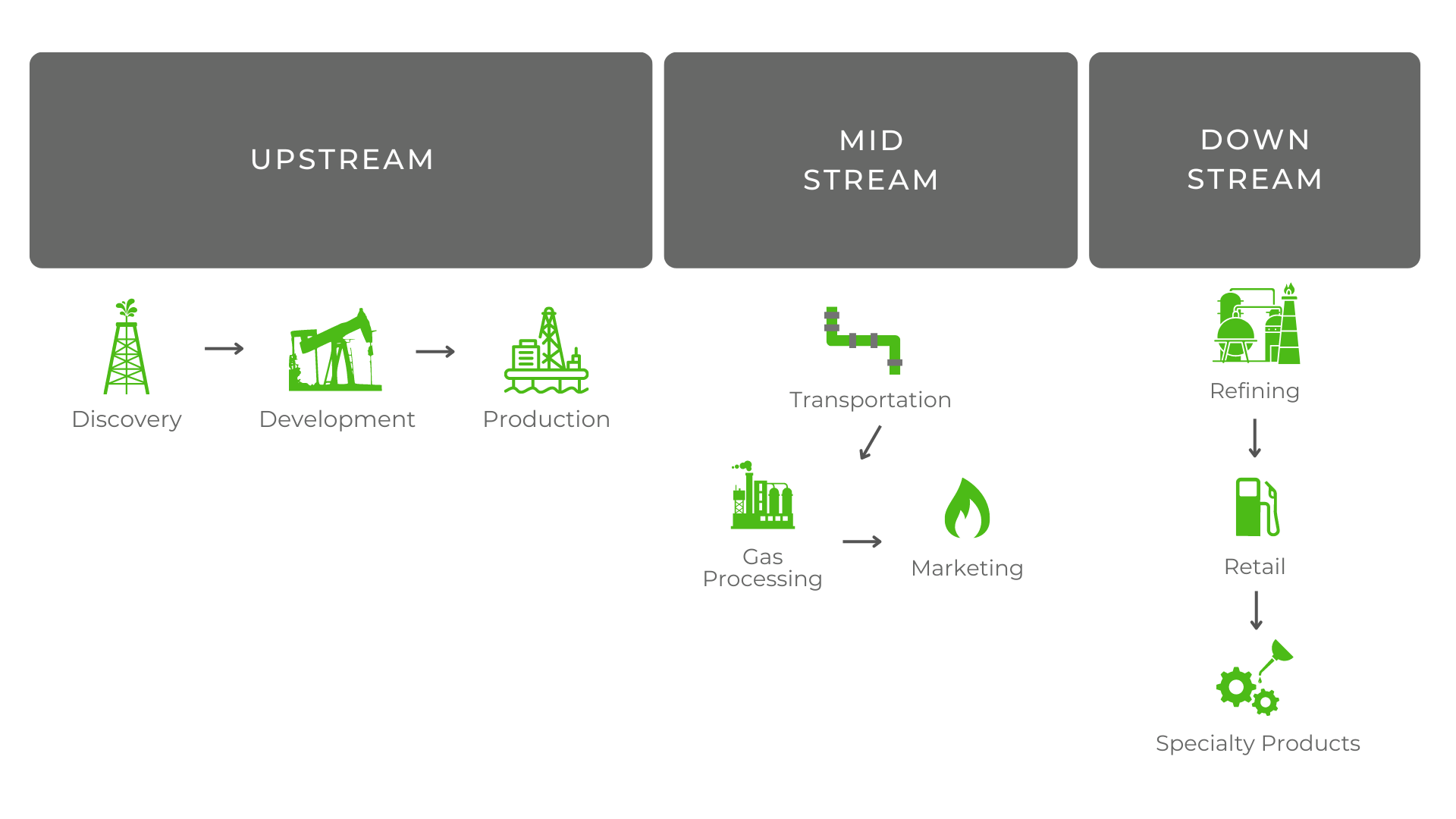

The oil and gas industry can be broadly divided into three core segments: upstream, midstream, and downstream. Each segment represents a distinct phase in the oil and gas value chain and performs specific activities related to exploration, production, transportation, refining, and distribution of oil and gas products.

Upstream

- Portfolio Optimization

- Asset Planning

- Long Range Planning

- Scenario Analysis

- Business Development

Midstream

- Volume Forecasting

- Capacity Panning

- Capital Projects

- Gas Processing Contracts

- Marketing

Downstream

- Volume Forecasting

- Revenue Forecasting

- Capital Projects/Turnaround

- Retail Planning

Increase Sustainable Cost Savings

- Optimized pricing & commercial incentive mechanisms

- Enable better positioning in future contract negotiations

- Identify additional savings through targeted contract negotiations

- Reduce creep of time & cost

Reduce Operational Costs

- Promote accurate invoicing & payment

- Simplify & consolidate contract structures

- Improved decision making

- Improved data governance

- Reduce the requirement to execute corrective contract reviews

Manage Risk Effectively

- Ensure operational, technical & financial changes are captured

- Align contracts to business outcomes / goals

- Prevent the implementation of ineffective contract terms

- Strong negotiation position on claims

- Assure supplier compliance with regulatory

Improve Delivery

- Ensure service delivery as per contractual terms

- Increase visibility and improve performance structures

- Improve quality of KPI’s and management information

- Allow better understanding & management of the supply chain

Improve Relationships with Suppliers

- Improved relationships through structured reviews

- Effective supplier management & management information

- Realize savings delivered through benefits tracking

- Allow contractual improvement & innovation

- Demonstrate performance & value to key stakeholders